KYC, an abbreviation for Know Your Customer, is for many companies a mandatory compliance process, that needs to be carried out when interacting with new customers. This applies when you open a bank account, need legal help, buy a house or a car and in many other areas.

These processes are usually carried out with protocol that are either insecure, not private or missing transparency for for regulators. With VeriSmart we are able to combine all the best features of cryptography and blockchain technology to achieve a protocol ensuring all these matters.

How the KYC process will work with VeriSmart

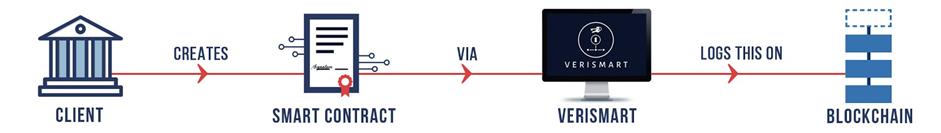

The process will start by the Client (Bank, Broker, Accountant, Gaming operator, Lawyer or other) using the VeriSmart Enterprise system to initiate a new smart contract based on the KYC template of choice.

From this point, the bank may invite the customer to join the process via e-mail, sms or simply offering the join code in person. This can be as simple as clicking a link in an sms, which takes the customer to the VeriSmart application and asking for the customers consent to join.

After joining the process, the customer is asked to provide a photo/scan of each document required by the template used. The software even supports such photo/scan to be electronically certified by a notary, lawyer or similar. The customer simply adds the document to the process, which will trigger an array of operations:

- The document fingerprint will be meassured and saved onto the blockchain

- The document is encrypted and the decryptiong phrase is encrypted with public key of the Client

- The encrypted Document and encrypted Document Key is uploaded to the VeriSmart cloud

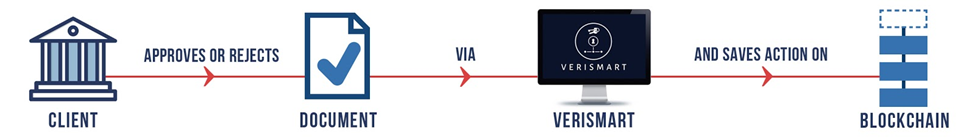

The Client are now able to download and decrypt each document uploaded by the customer.

Finally, the Client are able to either approve or reject each document, and each of these action will be saved on the blockchain.

If the client rejects any document, the customer will be pinged on their device asking for the document again to uploaded with the reason for rejection.

Once all documents in a process are approved, then the smart contract will terminate and accept no further actions. All actions as described are available on the blockchain and are, though private, fully auditable.

Benefits delivered by VeriSmart to this process

For the client

- A streamlined process for handling KYC procedure.

- Easy to update with new regulation requirements.

For the customer

- Keeping all personal and sensitive data completely private and only accessible for the intended recipient.

- Streamlined easy-to-follow process.

For regulators:

- Full audit trail of exact data exchange

- Option for automated audits